What is a 'Payroll'?

The 'payroll' of a business is the system used to calculate the salary (how much they are paid for their work) of each employee.

The inputs to a payroll system are:

The inputs to a payroll system are:

- Employee code (used to lookup the employee's other details, e.g. name, bank account, etc.)

- Hours worked

- Rate of pay (e.g. $25 per hour)

Pay = Hours Worked X Rate of Pay

The outputs from a payroll system are:

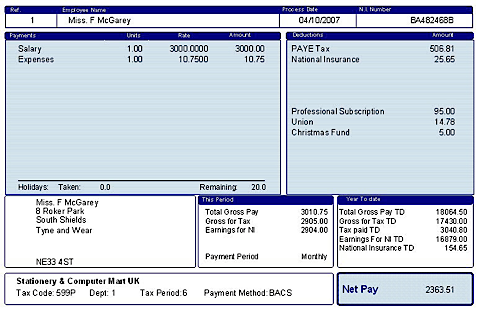

- A printed payslip (given to the employee to show how his/her pay was calculated)

- A cheque, or an EFT payment directly into the employee's bank account

How is a Payroll Processed?

The payroll is usually processed once a week or once a month (depending upon how often the business pays its employees).

This means that batch-processing is ideal for payroll processing:

This means that batch-processing is ideal for payroll processing:

- Working hours data is collected into a batch

- The data can be processed in one go at the end of the week/month

- The same calculations will be performed on all the data

- No user input is required during the processing

- The processing can be done during quiet times when the computer system is not being used for other things (e.g. at night)

Many places of work automatically record hours worked by the employees using systems such as swipe-cards or fingerprint readers.

When an employee arrives at work, they swipe their ID card, and then do the same when they leave.

Hours worked = Time out - Time in

When an employee arrives at work, they swipe their ID card, and then do the same when they leave.

Hours worked = Time out - Time in

Sometimes money may be added on to a person's pay (e.g. for working extra 'overtime')

Sometimes pay is taken away (e.g. as tax, or health insurance payments)

Sometimes pay is taken away (e.g. as tax, or health insurance payments)